Calculate the average rate of tax ie. Countries enter into Double Tax Treaties to elim inate or mitigate the incidence of juridical double taxation and avoidance of fiscal evasion in the international trade.

Pdf Government Ownership And Corporate Tax Avoidance Empirical Evidence From Malaysia Semantic Scholar

Agreement between the kingdom of Saudi Arabia and the Republic of Albania for the avoidance of double taxation and the prevention of tax evasion respect to taxes on income and on capital signed on 622019 and entered into force on 1122019.

. Income Tax Treaty PDF - 2006. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Tax avoidance lowers your tax bill by structuring your transactions so that you reap the largest tax benefits.

He Double Tax Avoidance Agreement is a treaty that is signed by two countries. Capital Gains Tax in Malaysia. Technical Explanation PDF - 1970.

Memorandum of Understanding between the US. In addition Korea is one of the countries that have joined the Multilateral Convention on Mutual Administrative Assistance in Tax Matters as of January 2022. It was introduced during Budget 2019 announcement on 2 November 2018.

Global income divided by the amount of tax. Kuwait has entered into tax treaties with several countries for the avoidance of double taxation. Rawling decided by the UK House of Lords in 1981 involved complicated tax avoidance scheme which were marketed in the UK in the 1970s.

Income Tax Treaty PDF - 1970. Tax evasion on the other hand is an attempt to reduce your tax liability by deceit subterfuge or concealment. Steps to compute Double Taxation relief.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card. Online Tax Training. Tax evasion is a crime.

1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status. Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return. DETAILS OF SRI LANKA DOUBLE TAXATION AVOIDANCE AGREEMENTS.

Aggregate of Indian income and Foreign income. Calculate Global Income ie. Tax Avoidance and Tax Evasion.

Tax Research Platform current. Guide to Transfer Pricing Documentation in Malaysia. Dual Residence Status And Agreements For The Avoidance Of Double Taxation Malaysia has entered into agreements with a number of countries that avoid double taxation by allocating.

AGREEMENT FOR AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH AFGHANISTAN Whereas the Government of India and the Government of Afghanistan have concluded an. Protocol PDF - 2006. In case there is DTAA with the Country then Tax Relief can be claimed us 90.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The agreement is signed to make a country an attractive destination as well as to enable NRIs to take relief from having to pay taxes multiple times.

The case established that a series of transactions with the purpose of tax avoidance which ultimately. And Belgium - 2009. The taxpayers who disclosed their assets did not face penalties or criminal sanctions.

Compute tax on such global income as per the slab rates applicable. The interpretation of tax treaties by the Kuwait Tax Authority is not always consistent or in line with the interpretation generally considered appropriate by the taxpayers and. Additionally Malaysia also has Double Tax Avoidance agreements with countries that tax their citizens residing in foreign lands.

IBFD - Tax Research Platform Menu. For avoidance of doubt fares and other surcharges would be treated in accordance to the relevant terms and conditions of the ticket. Technical Explanation PDF - 2007.

End of example If youre not entitled to a GST credit claim the full cost of the business purchase including any GST as a deduction. Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. If you are from one of these countries then you are exempt from paying income tax to the Malaysian government.

Tax avoidance is completely legaland extremely wise. From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed. TIEAs establish a framework for Korea to curb abusive tax avoidance transactions using tax havens as well as unveil and levy taxes on offshore tax avoidance transactions.

Receiving tax exempt dividends. 4 The individual is not in Malaysia or in Malaysia for a period of less than 90 days in the basis year. Comedian Jimmy Carr has been exploiting a tax scheme enabling him to pay only 1 tax and much of the criticism directed towards him has a moral dimension.

Norway implemented a tax amnesty program during 20082016 for taxpayers who had undisclosed assets hidden abroad. Finally only income that has its source in Malaysia is taxable.

Tax Revenue As A Percentage Of Gdp In Malaysia And The Oecd Countries Download Scientific Diagram

Pdf The Relationship Between Tax Evasion And Gst Rate

Pin On Shop One B December 2021

Summary Tax Avoidance And Offshore Wealth Policies For Tomorrow Eutax

Some Of The Best Methods To Prevent Tax Evasion Enterslice

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

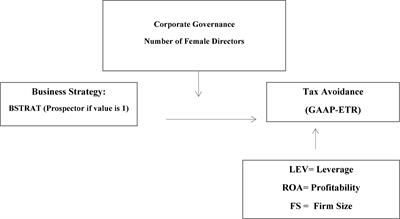

Corporate Business Strategy And Tax Avoidance Culture Moderating Role Of Gender Diversity In An Emerging Economy Frontiers

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificial Neural Network Method Analysis

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Pwc Alert Issue 116 Tax Avoidance

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar

Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

10 Benefits Of Nre Bank Account And Fixed Deposits Nri Saving And Investment Tips Savings And Investment Investing Investment Tips

Combating International Tax Avoidance Oecd